- Payment Fraud

Payment Fraud – Fake Checks and other Negotiable Instruments

Forged negotiable instruments, including fake checks, counterfeit U.S. postal money orders, phony cashier’s checks, fake traveler’s checks and counterfeit gift checks are an area of transaction–level fraud that each year causes significant losses for retailers, financial institutions and individuals.

Although difficult to quantify, payment fraud is part of a $220 Billion worldwide fraud problem that has been growing every year; together with a criminal element that continues to become more creative and efficient, companies of all sizes must react quickly to new threats from payment fraud.

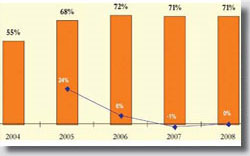

Almost three–quarters of organizations were victims of payments fraud in 2008, a result that is similar to that found in the two previous annual fraud surveys.

Prevalence of Counterfeit Checks

Although the volume of checks, both business and personal, is declining, checks are still the most widely used payment instrument for businesses. The number of checks used for payment fell by 7 billion between 2003 and 2006. However, checks continue to be the preferred target for criminals committing payments fraud. Nine out of ten organizations (91 percent) that experienced attempted or actual payments fraud in 2008 were victims of check fraud.

-

Attempted or Actual Payments Fraud and Percentage Change From Previous Year (Percent of Respondents)

Source: The Association for Financial Professionals 2009 Payment Fraud SurveyFraud Prevention – The Business Imperative

Fraud Fighter™ believes that these conditions require firms of all sizes to develop and implement a “layered” approach to fraud prevention. Beginning with a profile of the current state of fraud risk management, Fraud Fighter recommends an effective, business driven approach designed to reduce an organizations exposure to payment fraud

With a leading cost of ownership model, Fraud Fighter solutions include low cost tools that can be installed at the point–of–transaction to conduct a basic validation of documents and identification documents, while more sophisticated tools can be layered elsewhere (e.g. – manager’s office, credit center, etc.) to capture more complete information and conduct higher–level authentication of identity. The goal of the layered solutions are to DETER fraudulent behavior form occurring, to DETECT fraud as it occurs, and to enable COMPLIANCE with regulatory requirements when conducting certain types of account transactions.